Page 282 - riesgo2012

P. 282

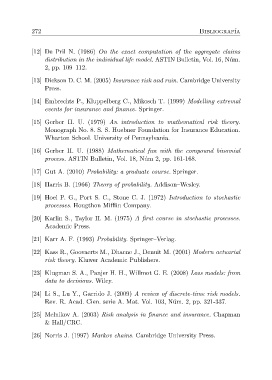

272 Bibliograf ´ ıa

[12] De Pril N. (1986) On the exact computation of the aggregate claims

distribution in the individual life model. ASTIN Bulletin, Vol. 16, N´um.

2, pp. 109–112.

[13] Dickson D. C. M. (2005) Insurance risk and ruin. Cambridge University

Press.

[14] Embrechts P., Kluppelberg C., Mikosch T. (1999) Modelling extremal

events for insurance and finance. Springer.

[15] Gerber H. U. (1979) An introduction to mathematical risk theory.

Monograph No. 8. S. S. Huebner Foundation for Insurance Education.

Wharton School. University of Pennsylvania.

[16] Gerber H. U. (1988) Mathematical fun with the compound binomial

process. ASTIN Bulletin, Vol. 18, N´um 2, pp. 161-168.

[17] Gut A. (2010) Probability: a graduate course. Springer.

[18] Harris B. (1966) Theory of probability. Addison–Wesley.

[19] Hoel P. G., Port S. C., Stone C. J. (1972) Introduction to stochastic

processes. Hougthon Mifflin Company.

[20] Karlin S., Taylor H. M. (1975) A first course in stochastic processes.

Academic Press.

[21] Karr A. F. (1993) Probability. Springer–Verlag.

[22] Kass R., Goovaerts M., Dhaene J., Denuit M. (2001) Modern actuarial

risk theory. Kluwer Academic Publishers.

[23] Klugman S. A., Panjer H. H., Willmot G. E. (2008) Loss models: from

data to decisions. Wiley.

[24] Li S., Lu Y., Garrido J. (2009) Areview ofdiscrete-time risk models.

Rev. R. Acad. Cien. serie A. Mat. Vol. 103, N´um. 2, pp. 321-337.

[25] Melnikov A. (2003) Risk analysis in finance and insurance. Chapman

& Hall/CRC.

[26] Norris J. (1997) Markov chains. Cambridge University Press.